As a financial services professional, your time is valuable. Unfortunately, spending hours searching for leads and sending messages can be frustrating and time-consuming. However, LinkedIn automation offers a solution to this challenge, allowing you to streamline the lead generation process and focus on what matters – building relationships and closing deals.

By automating tasks like sending connection requests, messaging, and content posting, LinkedIn automation tools can help you generate leads and expand your client base. With the help of these tools, you can easily reach out to a larger number of potential clients, improve engagement rates, and increase your chances of converting leads into clients.

Moreover, the financial services industry faces unique challenges regarding lead generation, such as regulatory constraints and limited access to decision-makers. By leveraging the power of LinkedIn automation, you can overcome these challenges and reach a wider audience.

In this blog post, we will explore the power of LinkedIn automation for financial services lead generation and provide tips for using these tools effectively. So, save time and grow your business with LinkedIn automation.

What is LinkedIn Automation?

LinkedIn automation includes the use of software to automate manual tasks on LinkedIn. These include sending automated connection requests, skill endorsement, follow-up messages, etc. These tools can help financial services companies streamline repetitive tasks such as sending connection requests, messaging potential clients, and sharing content on the platform.

One of the biggest benefits of LinkedIn automation is that it can save financial services professionals time and effort. By automating tasks, professionals can focus on building client relationships and closing deals instead of spending hours on manual tasks.

There are several LinkedIn automation tools available that can help financial services companies generate leads and expand their client base. These tools include:

- Automated connection request tools: These tools can automate sending connection requests to potential clients, saving time and increasing the number of connections.

- Messaging automation tools: These tools can be used to send personalized messages to potential clients in bulk, improving the chances of converting leads into clients.

- Content posting automation tools: These tools can help automate the process of sharing content on LinkedIn, making it easier for financial services professionals to engage with their audience.

Overall, LinkedIn automation can help financial services companies improve their lead generation efforts, expand their client base, and ultimately increase their revenue. However, using these tools ethically and in line with industry regulations is essential.

Why use LinkedIn automation for financial services lead generation?

LinkedIn automation has various benefits for financial services companies who want to build a lead pipeline for their business. Here are some of the key reasons why using LinkedIn automation can be beneficial for financial services lead generation:

1. Saves time

LinkedIn automation tools can help save time by automating repetitive and manual tasks. These tasks include following a profile, liking a post, endorsing a skill, etc. This way you’ll have more time to focus on other strategic tasks.

2. Increases efficiency

By automating tasks, financial services professionals can reach a larger number of potential clients, improving the efficiency of their lead generation efforts.

3. Improves engagement rates

Personalization is key to successful lead generation, and LinkedIn automation tools can help financial services professionals send personalized messages to potential clients at scale. This can improve engagement rates and increase the likelihood of converting leads into clients.

4. Provides targeted lead generation

LinkedIn automation tools can be used to target specific audiences based on industry, job title, and other relevant criteria. This helps financial services companies generate leads from a highly targeted pool of potential clients, increasing the chances of success.

Overall, using LinkedIn automation for financial services lead generation can be highly beneficial, allowing financial services professionals to save time, increase efficiency, improve engagement rates, and generate highly targeted leads in compliance with industry guidelines.

How to use LinkedIn automation for financial services lead generation?

Financial services businesses can use LinkedIn automation in various ways to generate leads, build relationships with potential clients, and grow their network. Here are some ways financial services businesses can use LinkedIn automation:

1. Connect with potential customers

LinkedIn is a professional networking platform where individuals and businesses can showcase their skills, experience, and expertise. As a result, individuals on LinkedIn are more likely to be receptive to business outreach efforts than on other social media platforms. Hence, it’s a great place for connecting with potential customers.

For example, you can use LinkedIn’ search feature to find your target audience and then send connection requests. If your target audience is ‘manufacturing business’, then type it in the LinkedIn search bar. Then, add filters such as location, company size, industry, etc.

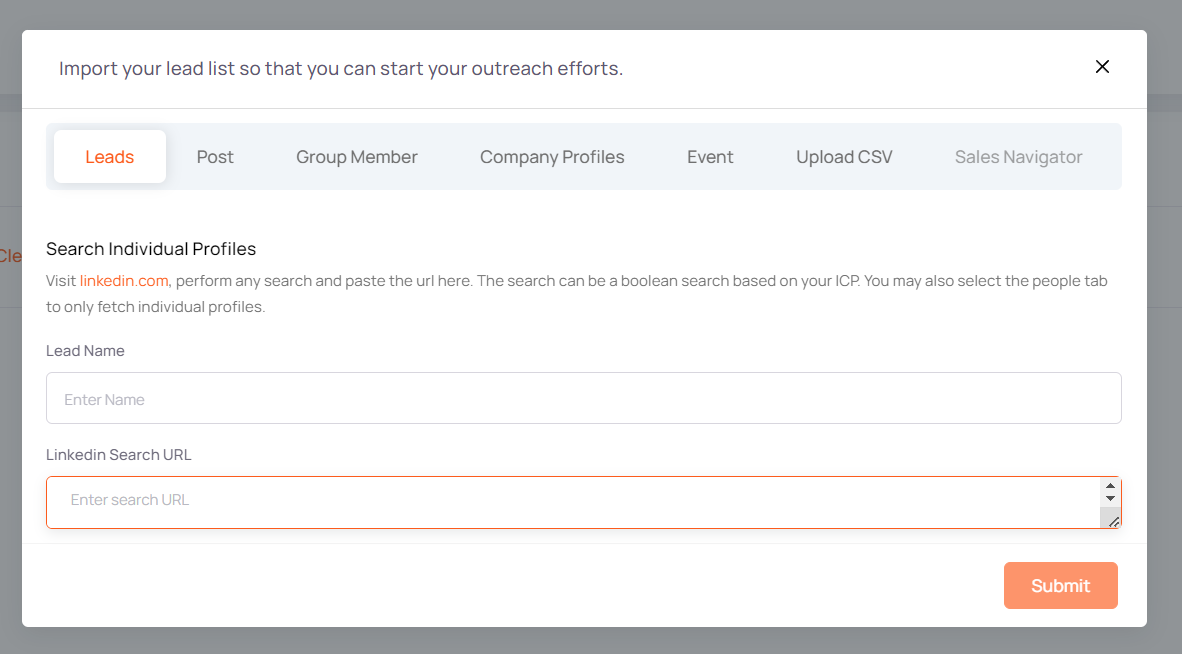

You can use a LinkedIn automation tool, such as expandi, and import leads from LinkedIn into the expandi dashboard. Next, you can set up a campaign for sending connection requests to people in the ‘manufacturing business’ leads list.

2. Send automated messages

Once a connection request is accepted, financial services businesses can use automation tools to send out personalized messages to potential clients. These messages can be customized based on the individual’s job title, industry, or interests. Personalization helps to build trust with potential clients and increase the chances of converting them into customers.

Here’s an example:

Dear [First Name],

I came across your profile on LinkedIn and noticed that you are the CEO of [Company Name]. As a leading provider of financial services to businesses in the [Industry] sector, we understand the unique challenges and opportunities that businesses like yours face.

We would like to offer you a personalized consultation to discuss how our cash management services, commercial loans, and business credit cards can help you achieve your business goals. Our team of experienced bankers can provide you with tailored solutions to meet your specific financial needs.

Please let us know if you are interested in learning more about our services and would like to schedule a consultation.

Best regards,

[Bank Representative’s Name]

3. Monitor and analyze your campaigns

LinkedIn automation tools provide analytics and reporting features that can help financial services businesses track their performance and optimize their lead generation strategy. Analytics features can track metrics such as connection requests sent, messages sent, and leads generated. Reporting features can provide insights into the performance of specific campaigns and help businesses make data-driven decisions.

LinkedIn automation best practices for financial services lead generation

It’s important to use LinkedIn automation correctly to achieve the best results. Here are some best practices for using LinkedIn automation for financial services lead generation:

1. Use a targeted approach

To successfully use LinkedIn automation, you must ensure that you reach out to the right target audience. For this, you’ll need to create an ICP or ideal client profile and use LinkedIn automation tools to reach out to them directly.

2. Personalize your messaging

While automation can help save time, it’s important to remember that personalization is vital to successful lead generation. Personalize your messaging using the recipient’s name and tailor it to their specific needs.

3. Follow up

Once you’ve connected with a potential client, it’s essential to follow up to keep the conversation going. Use LinkedIn automation tools to schedule follow-up messages and keep track of your interactions with potential clients.

4. Choose the right LinkedIn automation tools

There are many LinkedIn automation tools available, but not all are created equal. Choose a tool that’s specifically designed for financial services lead generation and offers the features you need.

5. Be ethical

Follow LinkedIn’s terms of service and ensure that your messaging is compliant with industry regulations.

By following these best practices, financial services companies can use LinkedIn automation to generate leads and expand their client base effectively and ethically.

Start building your client pipeline today

LinkedIn automation can be a game-changer for financial services lead generation. By using targeted outreach and personalized messaging, financial services companies can effectively expand their client base and generate more leads. With the right automation tools and a commitment to ethical practices, financial services companies can save time and focus on building relationships with potential clients.

Overall, it’s important for financial services companies to embrace technology and take advantage of the powerful tools available to them. LinkedIn automation is one such tool that can help financial services companies overcome the unique challenges of lead generation and reach new clients. By investing in automation and taking a strategic approach to lead generation, financial services companies can grow their businesses and thrive in a competitive market.

Recommended Reading:

Remember to supercharge your LinkedIn efforts by using a LinkedIn prospecting tool such as expandi.